Iowa 2025 529 Contribution Limits. In 2025, that ceiling is $6,500 if you're under 50 or $7,500 if you're 50 or older. The amount you can contribute to a 529 plan is higher in 2025.

If a participant (saver) is an iowa taxpayer, they can deduct up to $5,500 in contributions. Plus, there are no minimums to keep the account.

Governor reynolds has signed a bill into law that raises the maximum tax deduction for contributing to a “college savings iowa” account to $5200.

529 Plan Contribution Limits For 2025, Unlike retirement accounts, the irs does not impose annual contribution limits on 529 plans. You also need to do this strategically as you cannot rollover an amount greater than the annual roth contribution amount, which in 2025 is $7,000.

529 Plan Contribution Limits 2025 Aggy Lonnie, If you are a participant and also an iowa taxpayer, you can deduct up to $5,500 of your contributions per beneficiary account, including rollovers, from your iowa income taxes in 2025. This limit will likely be increased in future years.

529 Plan Contribution Limits Rise In 2025 YouTube, If a participant (saver) is an iowa taxpayer, they can deduct up to $5,500 in contributions. In 2025, that ceiling is $6,500 if you're under 50 or $7,500 if you're 50 or older.

Max 529 Contribution Limits for 2025 What You Should Contribute, In 2025, that ceiling is $6,500 if you're under 50 or $7,500 if you're 50 or older. Contributions to college savings iowa or the iadvisor 529 plan that were previously deducted for iowa income tax purposes must be included.

2025 Iowa Medicaid Limits Hatty Kordula, The deadline is generally april 30. Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary.

529 Plan Contribution Limits (How Much Can You Contribute Every Year, You can set up recurring contributions that occur monthly or. Beneficiaries are allowed to roll over up to $35,000 over their lifetime into a roth ira in their name (not the original 529 account holder’s name).

529 Plan Contribution Limit 2025 Millennial Investor, However, at high income levels,. Contributions to college savings iowa or the iadvisor 529 plan that were previously deducted for iowa income tax purposes must be included.

Irs Hsa Contribution Limits 2025 Patty Bernelle, 529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary. Maximum aggregate plan contribution limits range from $235,000 to $529,000 (depending on the state), but such limits generally do not apply across states.

The Making Of 529 Child Millionaires To Pay For Tuition, They range from $235,000 to upward of $500,000. Contributions to college savings iowa or the iadvisor 529 plan that were previously deducted for iowa income tax purposes must be included.

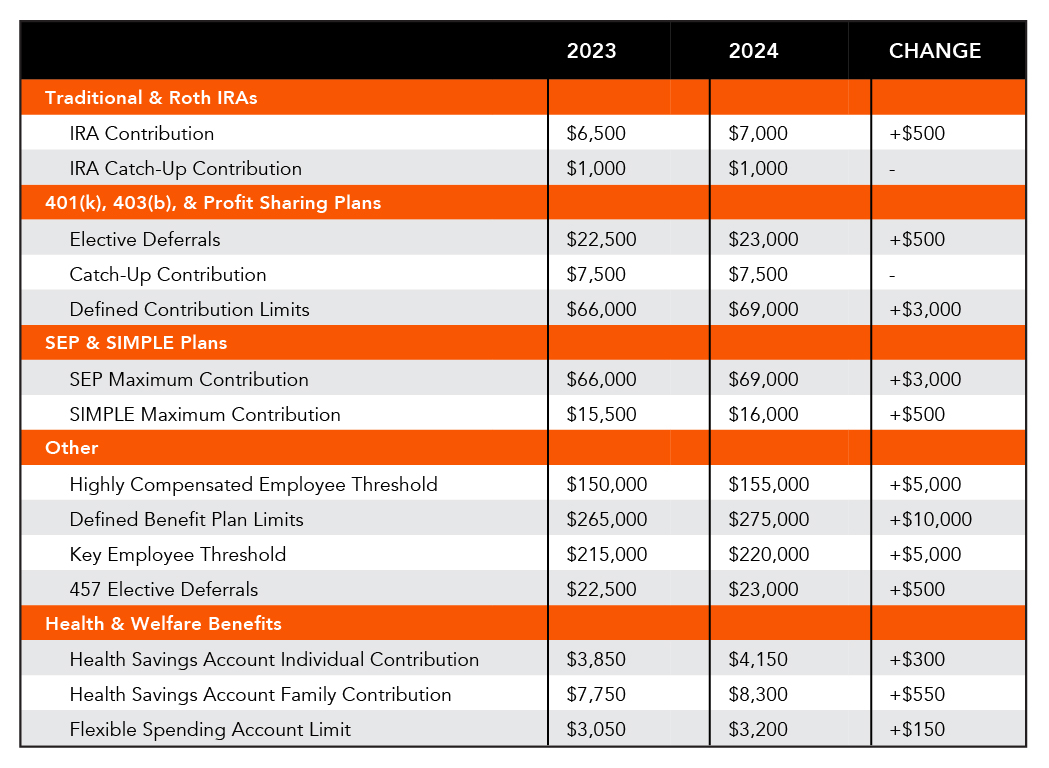

Plan Sponsor Update 2025 Retirement & Employee Benefit Plan Limits, They range from $235,000 to upward of $500,000. Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary.

Iowa offers a state tax deduction for contributions to a 529 plan of up to $3,875 for single filers and $7,570 for married filing jointly tax filers per beneficiary.

Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary.

Sheryl Crow 2025 Grammys. A powerhouse of activism and philanthropy,. Sheryl crow's debut solo album, […]