Due Date For March 2025 Tax Payment. If you are unable to meet this deadline, your business cannot request additional time. You should pay any owed taxes by.

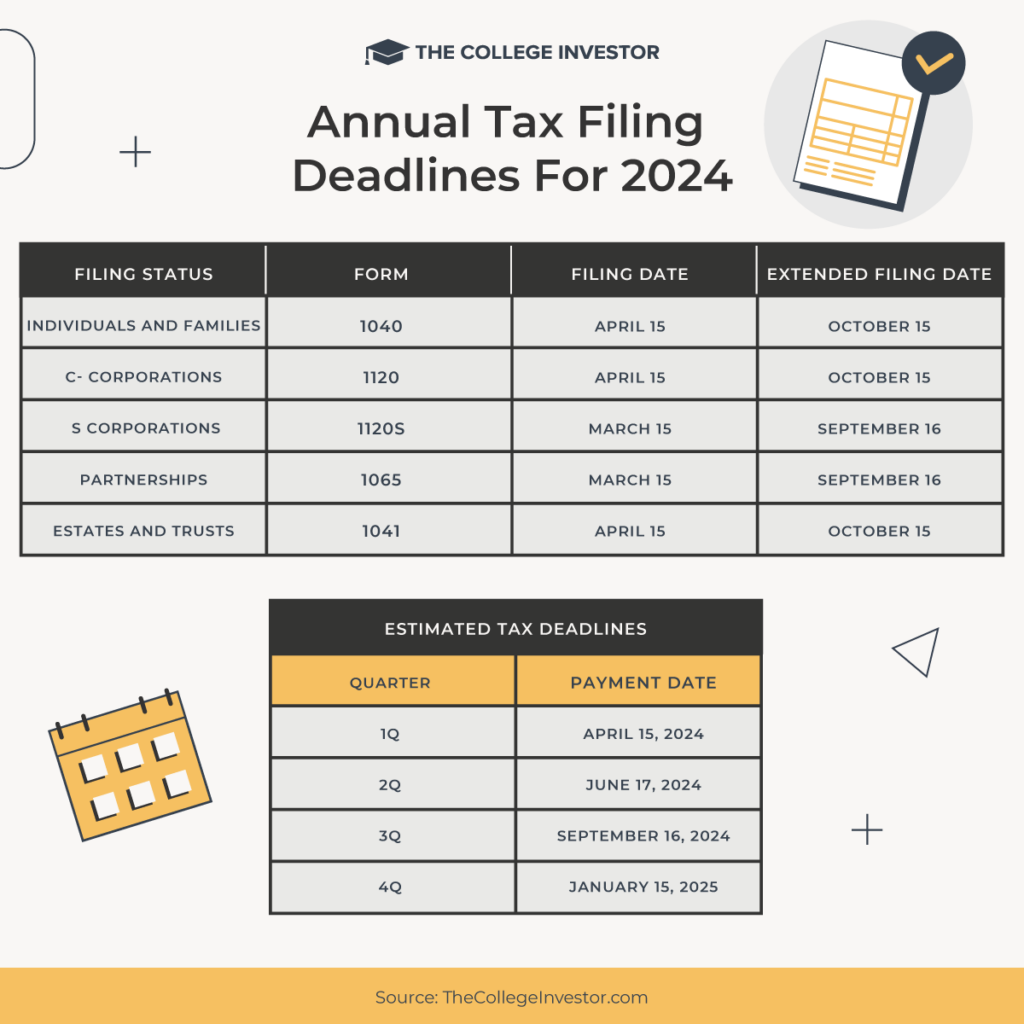

Our due dates by month and due dates by topic give you key dates to help you lodge and pay on time. For a more comprehensive list of dates and deadlines for individuals and businesses, explore irs publication 509.

Remember these Due Dates Tax Compliance Calendar for March 2025, Up to and including 12 february 2025, the payment date.

Ca Estimated Tax Payments 2025 Due Dates Dani Nichol, The third estimated tax payment is due on sept.

Tax Due Dates For 2025 (Including Estimated Taxes), Companies and super funds with total income over $2 million in their previous return must lodge, unless already.

Irs 1099 Filing Deadline 2025 Due Time Lynea Rosabel, When a due date falls on a saturday, sunday or public holiday, you can lodge or pay on the next business day.

Quarterly Tax Payments 2025 Due Dates 2025 Kiri Ophelie, For a more comprehensive list of dates and deadlines for individuals and businesses, explore irs publication 509.

Estimated Tax Due Dates 2025 Irs Nola Whitney, When a due date falls on a saturday, sunday or public holiday, you can lodge or pay on the next business day.

Estimated Quarterly Taxes 2025 Due Dates Irs Tobe Rhetta, Our due dates by month and due dates by topic give you key dates to help you lodge and pay on time.

When Are 2025 Estimated Tax Payments Due Ajay Lorrie, If you file using a fiscal year — that is, your tax year ends in any month other than december — your tax return is due on or before the 15th day of the fourth month after your.