Airline Pilot Tax Deductions 2025. The airline pilot's life looks exciting at first glance: If my airline pilot per diem is listed in box 12 with code l, can i claim dot regulations on my tax return?

(one bizarre loophole, since closed, meant that passengers on the world’s. Tax deductions for flight crew;

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

Make the Most of the Tax Break in Airline Pilot Tax Deductions TFX, According to the irs, pilots are subject to state taxes in the state in which they live (i.e. Participating in the program is.

Pilot Taxes Pilot Tax Deductions Flight Crew Tax Flight Attendant, The airline will pay a pilot for a minimum number of flight hours, regardless of whether those hours were actually flown. Read up on tax concerns.

Accelerated Commercial Pilot Program Application Orange County Flight, (one bizarre loophole, since closed, meant that passengers on the world’s. Tax returns for flight attendants;

10 Year Pilot Demand Infographic Pilot, Low cost carrier, Pilot career, What taxes do pilots pay? The airline will pay a pilot for a minimum number of flight hours, regardless of whether those hours were actually flown.

airline pilot flight attendant check in ticket Stock Photo Alamy, According to the irs, pilots are subject to state taxes in the state in which they live (i.e. In this section of our tax booklet, we'll discuss the law governing the tax deductibility of aircraft expenses, along with cases and rulings that can help you interpret the law.

Airline Pilot Tax Deduction Worksheet Escolagersonalvesgui, In this section of our tax booklet, we'll discuss the law governing the tax deductibility of aircraft expenses, along with cases and rulings that can help you interpret the law. They get a free pass to explore new places and experience different cultures.

an Airline Pilot Airline Pilot Pay Professional Pilot, The tax bill with aviation benefits is considered a foundation for big changes expected in 2025. The flight crew is responsible for filing income tax returns and claiming the pilot tax deductions.

AIRLINE PILOT FUEL CALCULATION TEST How 2, According to the irs, pilots are subject to state taxes in the state in which they live (i.e. If my airline pilot per diem is listed in box 12 with code l, can i claim dot regulations on my tax return?

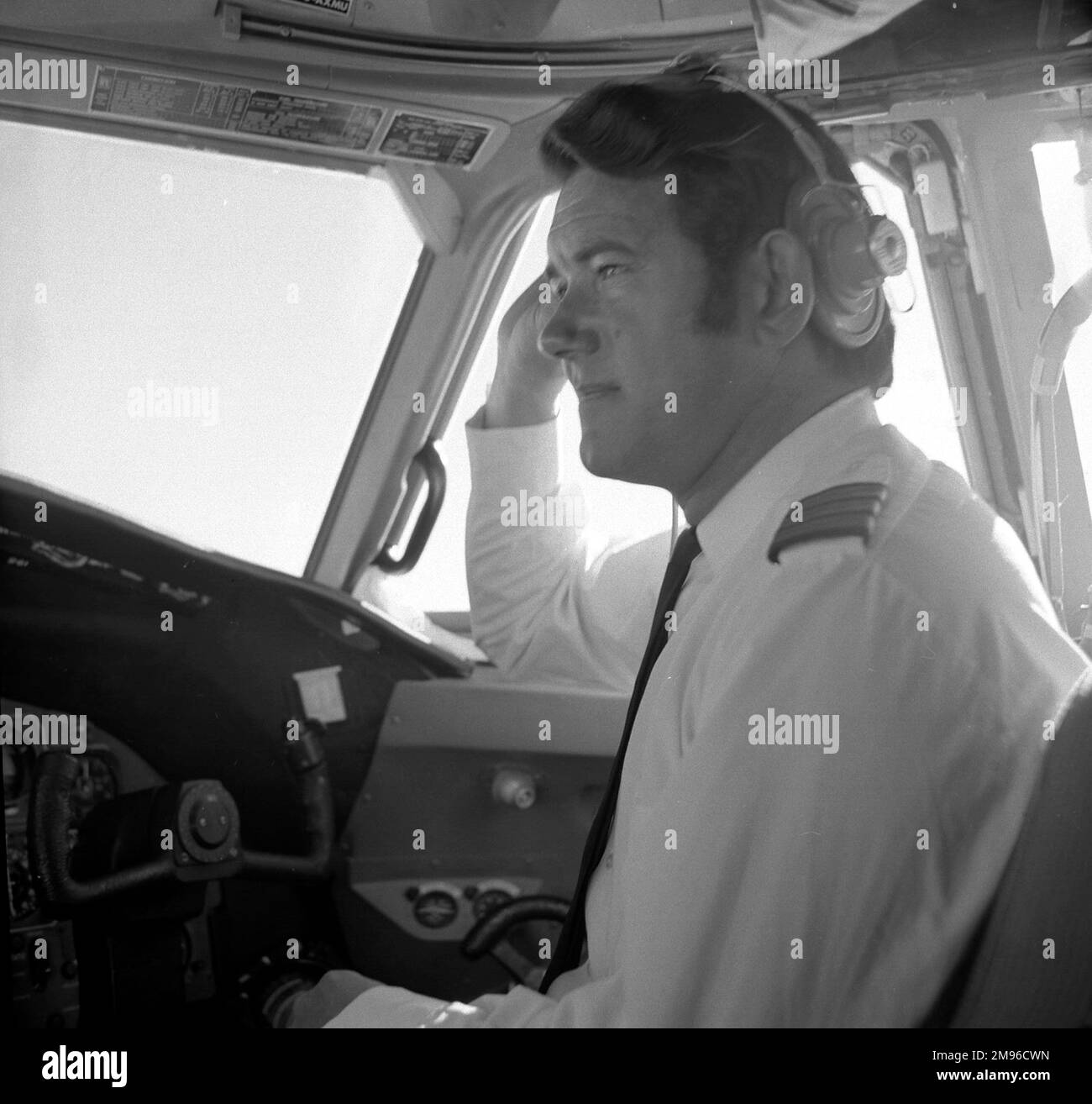

An airline pilot at the controls of his plane Stock Photo Alamy, Domestic per diem will be adjusted annually, effective january 1, and equal 90% of a weighted average based on the u.s. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

Airline Pilot Salary Philippines Company Salaries 2025, Tax returns for flight attendants; Per diem reimbursements paid to pilots by their employers.

Their state of residence) and also any state where they earn more than 50% of their income as a pilot.

Gerard Way Interview 2025. Gerard way on dc comics' young animal imprint, his musical detour […]

Richmond Top Doctors 2025. Ophthalmology published december 30, 2025 by virginia business dr. Sentara internal […]